SINGAPORE, Oct. 9, 2024 /PRNewswire/ -- Surfin, a financial technology platform dedicated to serving the underserved middle class, has raised $12.5 million from Insignia Ventures Partners. This funding round comes as Surfin announces its service to 60 million individuals across eight countries on three continents, with approximately $2.7 billion in cumulative transactions.

Founded in 2017 and headquartered in Singapore, Surfin began with consumer lending and expanded into a suite of financial services including payments and remittance, credit card issuance, and wealth management. Leveraging AI and analytics, Surfin is committed to offering an ecosystem of transparent and innovative financial services to the growing middle class that is often overlooked by traditional banking systems.

The company has a significant presence in Indonesia, Mexico, Philippines, Nigeria, Kenya, India, Uganda, and Australia. In Indonesia, its largest market, Surfin holds licenses for P2P lending, mutual fund distribution, remittance, and payment gateway services.

This Series A round marks Surfin's first external funding since its inception, having been bootstrapped and self-financed without any third-party debt.

Surfin's Founder and CEO, Dr. Yanan Wu, said: "Surfin's vision has always been to build a financial technology services ecosystem on top of our scalable and sustainable risk management system, powered by AI and big data. This system has been stress-tested by the behavior of 60 million users across three continents. Recently, we've leveraged this system to launch remittance, payment, wealth management, and credit card services, deepening our mission of financial inclusion in the markets where we operate."

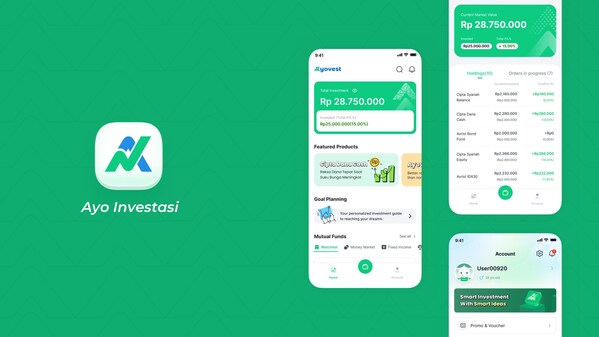

In 2023, Surfin launched Ayovest in Indonesia, a mutual fund trading platform designed for young, first-time investors to invest productively and safely, starting from as low as IDR 10,000. Ayovest has been operating under the license of the OJK since its inception.

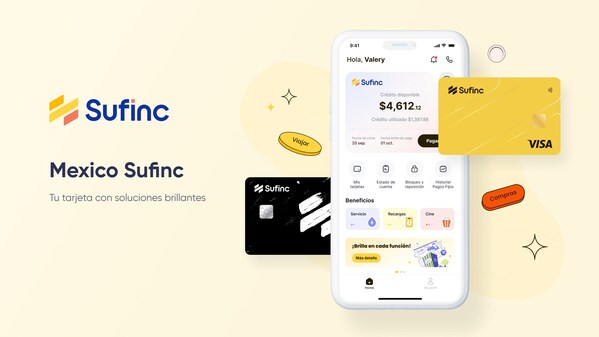

Also in 2023, Surfin established its credit card business in Mexico, "Sufinc," in partnership with Visa. Sufinc offers a credit card designed to strengthen Surfin's consumer finance presence in Central America, with flexible payment terms, no annual fees, and global acceptance.

Seasoned Finance Executives Drawn to Surfin's Mission of Financial Inclusion in the Era of AI

More than 2500 people across the globe have joined Dr Wu on Surfin's mission. Its leadership team includes former Shopee, Akulaku, and Baidu executives. Surfin is also advised by a board composed of accomplished, multi-hyphenate finance

L-R: Surfin Board of Directors at the Surfin Investment Forum: 2. John A. Quelch CBE, 3. Mohamed Nasser Ismail, 4. John Fennell, 5. Michael Spence, 6. Dr Yanan Wu, 7. Bruce McGuire, 8. Felix Davidson at Surfin Investment Forum

Surfin's Board Member, Nobel laureate Michael Spence, commented:"Surfin has the potential to reshape financial mobility and inclusion for millions of families globally. I have a long-standing interest in asymmetric information in markets and the challenges it presents. Surfin's approach to addressing the information challenges of credit access through AI and data science is innovative and much-needed. It's a privilege to support its mission of advancing financial inclusion."

Surfin's ecosystem of products is powered by a unified credit scoring engine, enabled by AI and data analytics. This core technology allows Surfin to lend sustainably at scale across different geographies and enter new financial service use cases.

Surfin's ambitions to scale its consumer loans business and reach more consumers across income classes with a full suite of products, from robo-advisory to remittances, laid the groundwork for the partnership with Insignia Ventures Partners and Surfin's first round of institutional funding.

Founding Managing Partner Yinglan Tan shares, "Surfin represents two key shifts in the way companies are growing from Southeast Asia. It is a company headquartered and operating in the region, but with a multi-country presence and global ambitions from early on. It is also a company leveraging the wave of AI transforming industry to deliver more equitable credit access to the underbanked. In a space that is highly competitive and challenging at scale, this combination of proven multi-market entry with licensed multi-jurisdiction products and robust risk management capabilities positions them in a unique place to scale. Their operational track record is more impressive considering they have been bootstrapped thus far. We are privileged to be working with Dr Wu and his team to scale their financial services ecosystem further, both in terms of reach and use cases."

Know More About Surfin: https://www.surfin.sg/

Article: https://review.insignia.vc/2024/10/08/surfin-series-a/

source: Surfin

【你點睇?】渣馬4名內地跑手被取消資格,4人同屬一個經理人,號碼布疑被調換,你認為主辦方應否酌情處理?► 立即投票